Financial wellbeing

Financial wellbeing, sometimes known as financial wellness, is all about having a healthy relationship with your money. It’s not just about having enough money in the bank. It’s about feeling in control of your finances, managing it in a way that brings you peace of mind and reduces stress, feeling secure about your financial future, and being prepared for the unexpected.

Money enables us to do the things we want in life, but we know that for many people, it causes stress and anxiety. We founded RiseUp to address this problem. We’re here to make managing your money quick and easy, and to help you take control of your financial future with confidence.

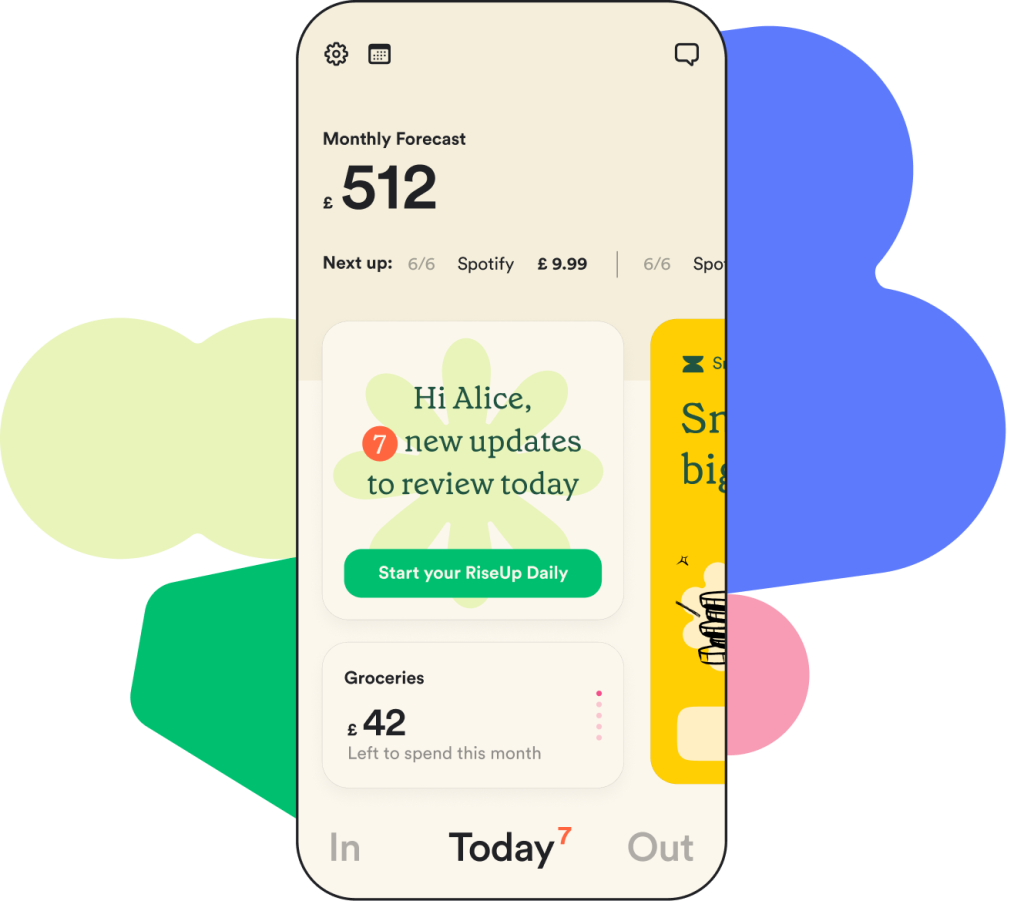

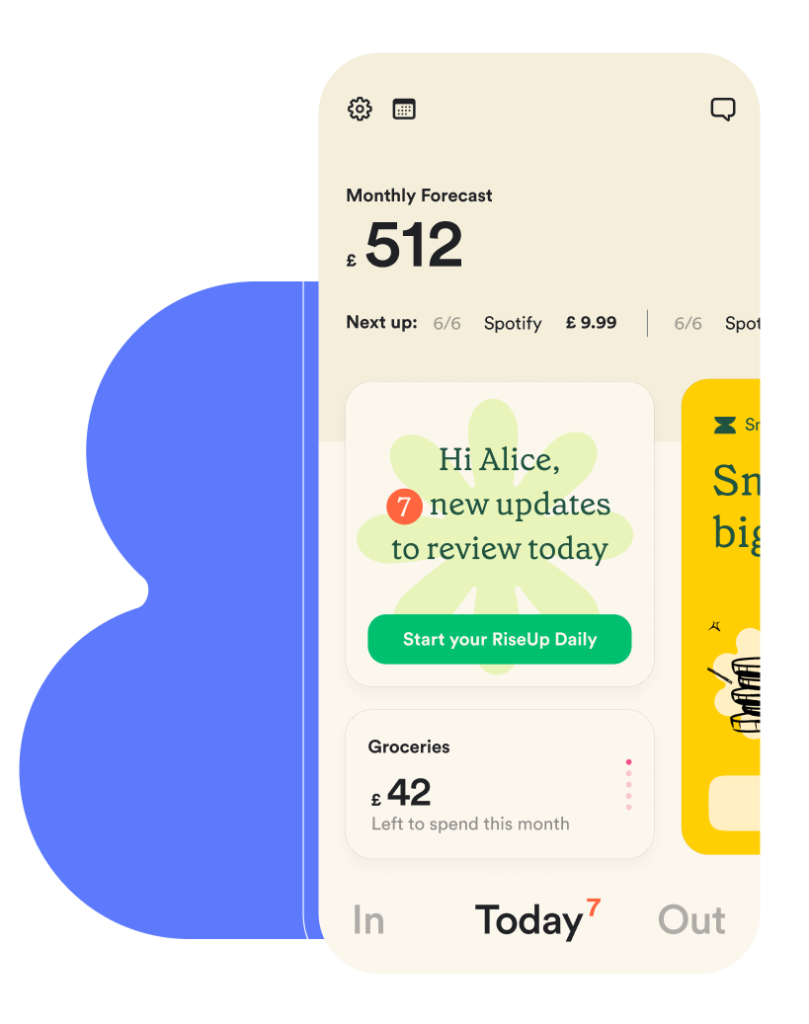

Our user-friendly app puts your financial wellbeing first. Harnessing the power of technology and open banking, we make it a breeze to get on top of your finances, feel good about your spending, and save for the future.

Financial wellbeing

Financial wellbeing, sometimes known as financial wellness, is all about having a healthy relationship with your money. It’s not just about having enough money in the bank. It’s about feeling in control of your finances, managing it in a way that brings you peace of mind and reduces stress, feeling secure about your financial future, and being prepared for the unexpected.

Money enables us to do the things we want in life, but we know that for many people, it causes stress and anxiety. We founded RiseUp to address this problem. We’re here to make managing your money quick and easy, and to help you take control of your financial future with confidence.

Our user-friendly app puts your financial wellbeing first. Harnessing the power of technology and open banking, we make it a breeze to get on top of your finances, feel good about your spending, and save for the future.

Financial control

Being in control of your money means you’re the one calling the shots, rather than your financial situation controlling your life. Financial control is about managing your money effectively day-to-day, understanding where it goes and balancing income with expenses.

This involves budgeting, tracking your spending and making informed decisions. With RiseUp, you can keep track of all your spending in one place, see your income and expenses sorted into categories, make changes to your budget based on personalised recommendations, and more.

Be ready for the unexpected

Life is full of surprises, and a positive relationship with money means being financially prepared for the unexpected. Think of it as financial resilience – having a safety net to handle unforeseen financial shocks, like job loss or surprise bills. Building an emergency savings fund, if you’re able to, can really help you feel more relaxed about money.

RiseUp helps you boost your financial fitness and resilience by suggesting personalised tips and insights to help you build and maintain your savings, ensuring you’re prepared for whatever comes your way.

Financial security

At RiseUp, we believe everyone deserves to feel secure, stable and confident about their money. This is what we mean by financial security and it looks different for everyone. For one person this might mean having a basic understanding of financial products (like the different types of savings accounts, for example), for someone else it might mean paying off debt and putting a plan in place to save for your future goals.

RiseUp gives you the tools and personalised knowledge to help you feel more secure and at peace with your money in both the short and long term.

Stress reduction

For many of us, money is a huge cause of worry. Financial stress is the anxiety and worry that comes from financial instability. It can impact your mental health, relationships and overall wellbeing. Recent RiseUp research revealed that for 56% of British people, money worries affect their mental health, and this financial stress affects every aspect of our lives: not just our mental health, but our relationships, eating habits, sex lives, work performance and friendships.

RiseUp’s personalised financial insights, practical budgeting tools and supportive community can make you feel more in control of your money.

Achieve goals

Everyone’s money goals are different, but one thing is universally true: achieving them boosts our overall sense of financial wellness. It’s like a virtuous cycle, whereby it becomes easier to keep working towards and reaching other money goals the more confidence we have.

Whether you’re paying debt, buying a home, saving for retirement, or planning a holiday. This confidence comes from understanding your money, having a clear plan and putting it into practice.

With the RiseUp app and community, you gain the guidance and support to set, pursue and achieve your financial goals, ensuring a more secure and fulfilling financial future.

Financial peace of mind

We use apps for our mental health, so why not for our financial health? Using RiseUp will lead to financial peace of mind – stability, reduced money stress and freedom to focus on personal goals.

Mastering financial wellbeing – and achieving financial peace of mind – involves understanding and managing the factors impacting your financial health. This strengthens mental health and personal relationships while ensuring money for your goals.

RiseUp helps you control your money, reduce stress and balance financial security and personal fulfilment, enhancing your overall wellbeing and life satisfaction.

Our Plans

Choose a plan

and get started

Monthly + 7 day free trial

£9.99/month

After your free trial, the monthly subscription is £9.99 and automatically renews each month.

Quarterly + 7 day free trial Most Popular

£25.99/3 mo

(£8.69/mo)

After your free trial, the quarterly subscription is £25.99 and automatically renews every 3 months.

Annual + 7 day free trial Save 20%

£95.99/year

(£7.99/mo)

After your free trial, the annual subscription is £95.99 and automatically renews each year